net of a tax impact of 3,071, as of September 1, 2018. To see if these forms provide a section to enter business termination information.Ĭheck with your state's department of revenue and unemployment office for their tax filing requirements when a business is closed. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by. If you file state employment tax returns to report state withholding taxes, check Check your state for the most current information. Tax laws change frequently, even at the state level.

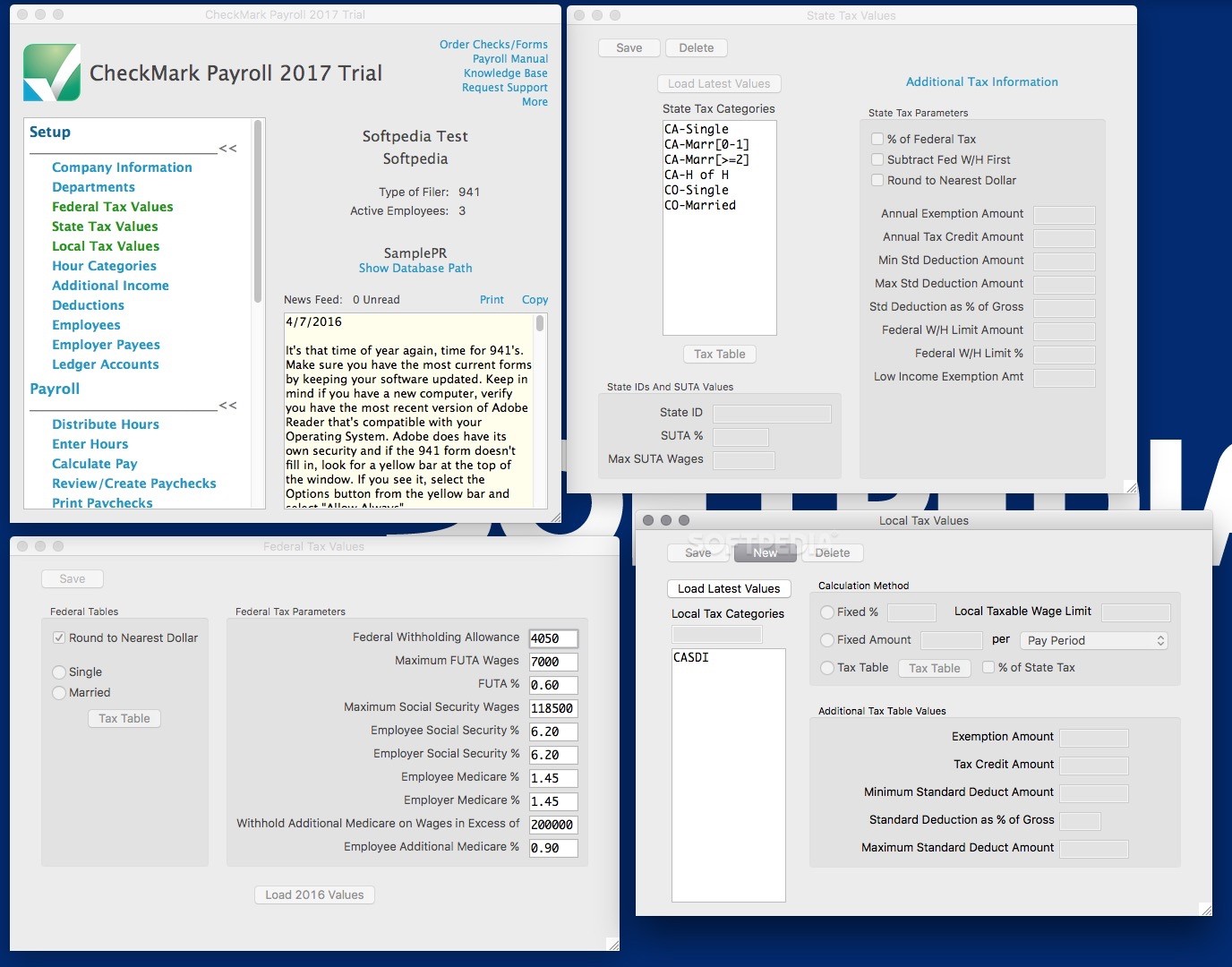

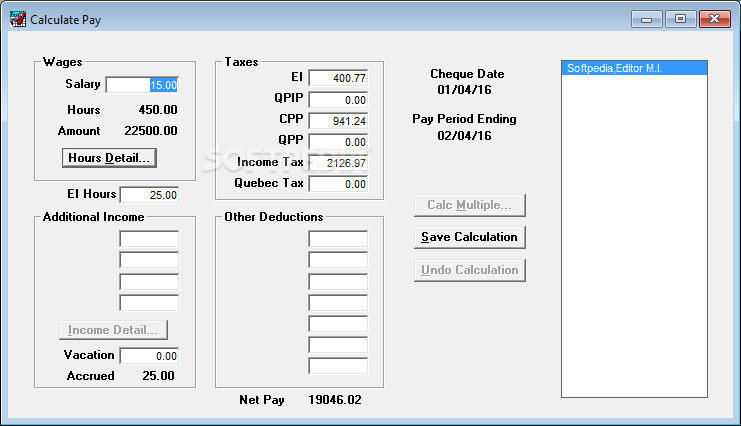

Generally, sales tax returns have a box where you place a checkmark if it's your final return and to have your sales tax permit canceled. If you had employees, a state unemployment tax return is generally filed quarterly.Ĭheck your return to see if it provides a place to enter business termination information. In CheckMark Payroll for Windows version 4.0. When you close your business, in addition to filing your final federal tax returns and paying any taxes due, you may also have state taxes to deal with. Then, click State Taxes in the Command Center, click Load Latest Tables then click OK. Find current rates in the continental United States ("CONUS Rates"). Rates are set by fiscal year, effective October 1 each year. What does that mean, you ask A green checkmark (Verified) indicates that game is fully verified to run well on Steam Deck a yellow checkmark (Playable).

CHECKMARK PAYROLL 2018 TAXES SOFTWARE

You can also use the new per diem tool to calculate trip allowances CheckMark MultiLedger Small business accounting software thats multi-user & cross-platform.

General Services Administration Search by city, state or ZIP code, or by clicking on the map.

0 kommentar(er)

0 kommentar(er)